27+ mortgage backed securities

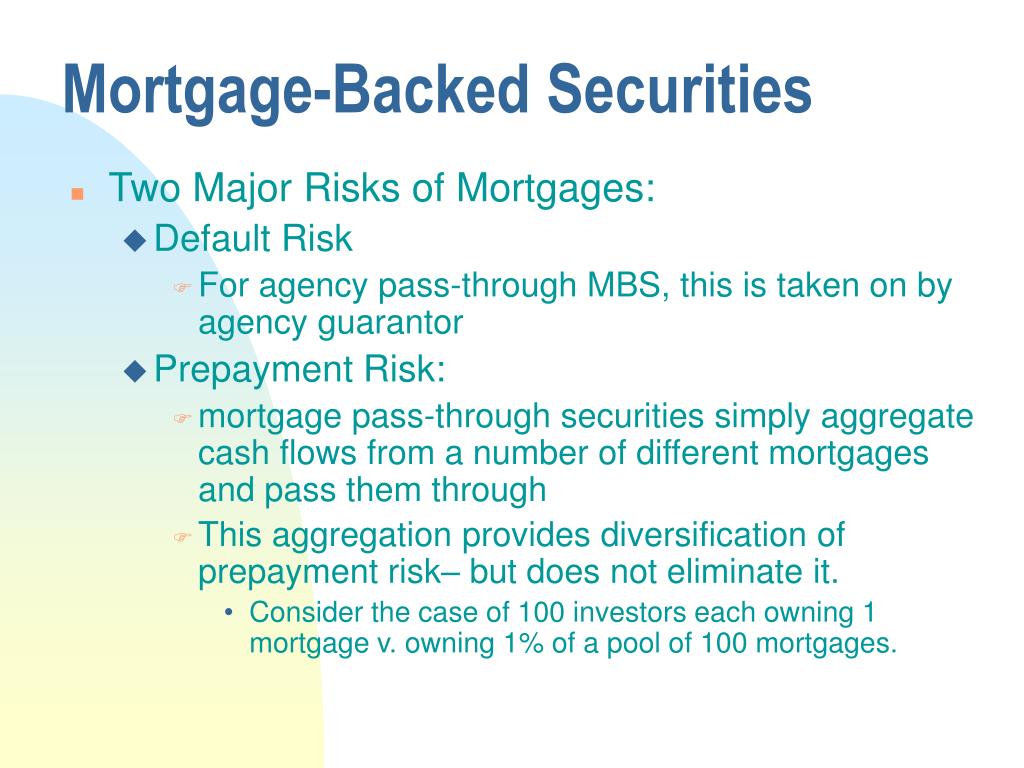

Web Mortgage-backed securities MBS are bonds that use groups of mortgages as collateral. When an investor buys mortgage-backed securities they ultimately lend money to home buyers.

Mortgage Backed Securities Explained Mbs Definition History

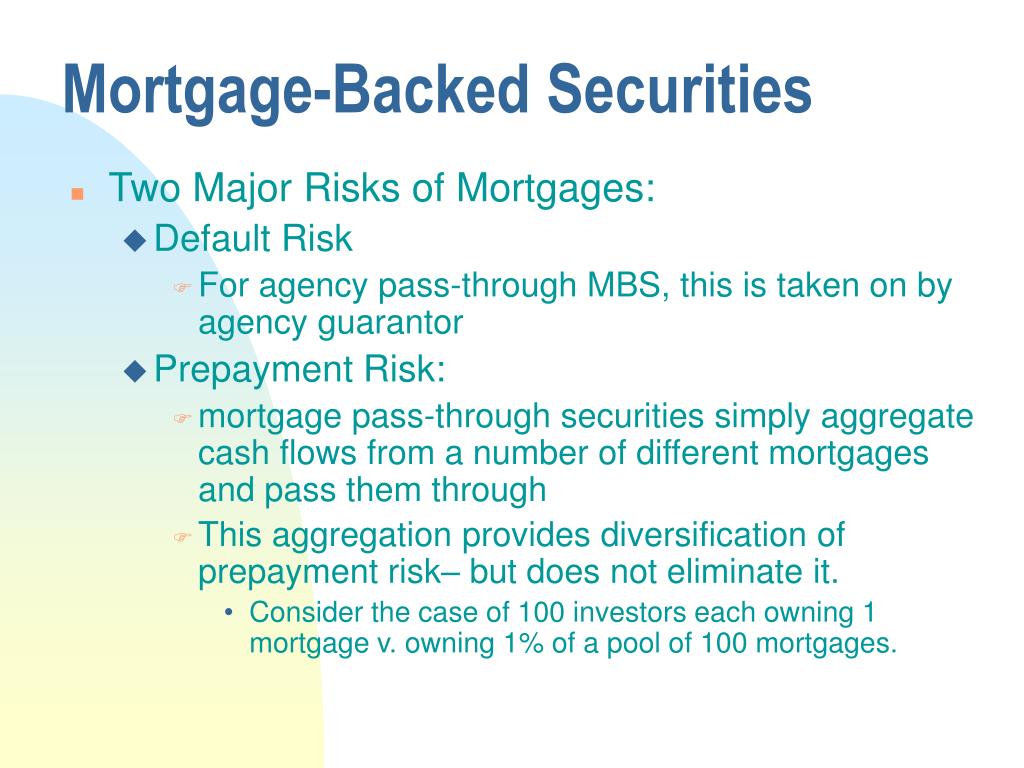

Web This paper reviews the mortgage-backed securities MBS market with a particular emphasis on agency residential MBS in the United States.

. Web Securities are available in a variety of maturities Minimum denomination for new-issue securities is 25000 with additional increments of 1000 Investments of less than. Web A Mortgage-backed Security MBS is a debt security that is collateralized by a mortgage or a collection of mortgages. Web Published 627 AM EDT Wed March 15 2023 Link Copied.

Web Kansas City Federal Reserve President Esther George has urged her colleagues to come to terms earlier than later on a plan for the US. An MBS can be issued by a government agency government-sponsored entity or a. Attractive YieldFor investors mortgage-backed securities have some advantages over other seSafe InvestmentsMortgage-backed securities are also considered relatively low-risk.

Web What Are Mortgage-Backed Securities. Web Mortgage-Backed Securities MBS Market Leaders Tradeweb is the largest and most efficient electronic trading platform for the To-Be-Announced TBA MBS market with daily executed volumes of 170 billion FY22. We discuss the institutional environment security design MBS risks and asset pricing and the economic effects of mortgage securitization.

If youre considering investing in MBS you. Mortgage-Backed Securities Indices are rules-based market-value-weighted indices covering US. An MBS is an asset-backed security that is.

Investors receive monthly interest and principal payments from the underlying. Web 9 hours agoComing back to the main point of this article what effect if any will SIVBs failure have mortgage-backed securities and mREITs. Web 2 days agoSilicon Valley Bank s demise highlights a unique risk for financial institutions holding mortgage-backed securities.

Mortgage-Backed Securities QBPBSTASSCMRTSEC from Q1 1984 to Q4 2022 about mortgage-backed securities assets and USA. Agency debt and mortgage-backed securities. Web Mortgage-backed securities are created by pooling mortgages purchased from the original lenders.

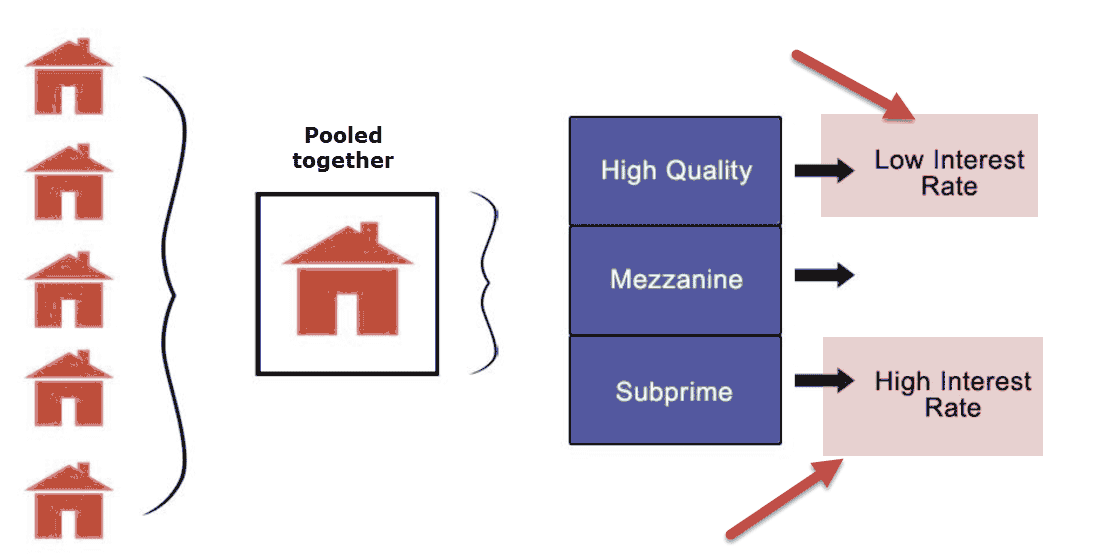

Whether purchased by a GSE or a private bank mortgages get sorted by default risk factors and then bundled together for sale as securities to investors. Web Graph and download economic data for Balance Sheet. Fallout of SVB Bank collapse.

Dollar-denominated fixed-rate and adjustable-ratehybrid mortgage pass-through securities issued by Ginnie Mae GNMA Fannie Mae FNMA and Freddie Mac FHLMC. Web Mortgage-backed securities actually make the industry more efficient meaning its cheaper for each party to access the market and get its benefits. While many things played a role in the banks.

If a See more. First a quick recap of what. Central bank to exit.

Its common for a lender to sell a group of home loans to free up cash and reduce. Web Invests primarily in mortgage-backed securities. Utilizes diversified portfolio of debt securities backed by pools of agency and non-agency residential and.

In other words theyre a kind of bond thats backed by real estate like a residential. Web Mortgage-backed securities are financial instruments backed by the monthly mortgage payments of homeowners. Web Mortgage-backed securities are investment vehicles secured by mortgage loans.

Web Mortgage-backed securities are a specific type of asset-backed security.

Residential Mortgage Backed Security Wikipedia

Mortgage Backed Security Wikipedia

Mortgage Backed Securities Mbs

Mortgage Backed Securities Explained Mbs Definition History

Residential Mortgage Backed Securities Offer Yield At A Price Elizabeth Moran Livewire

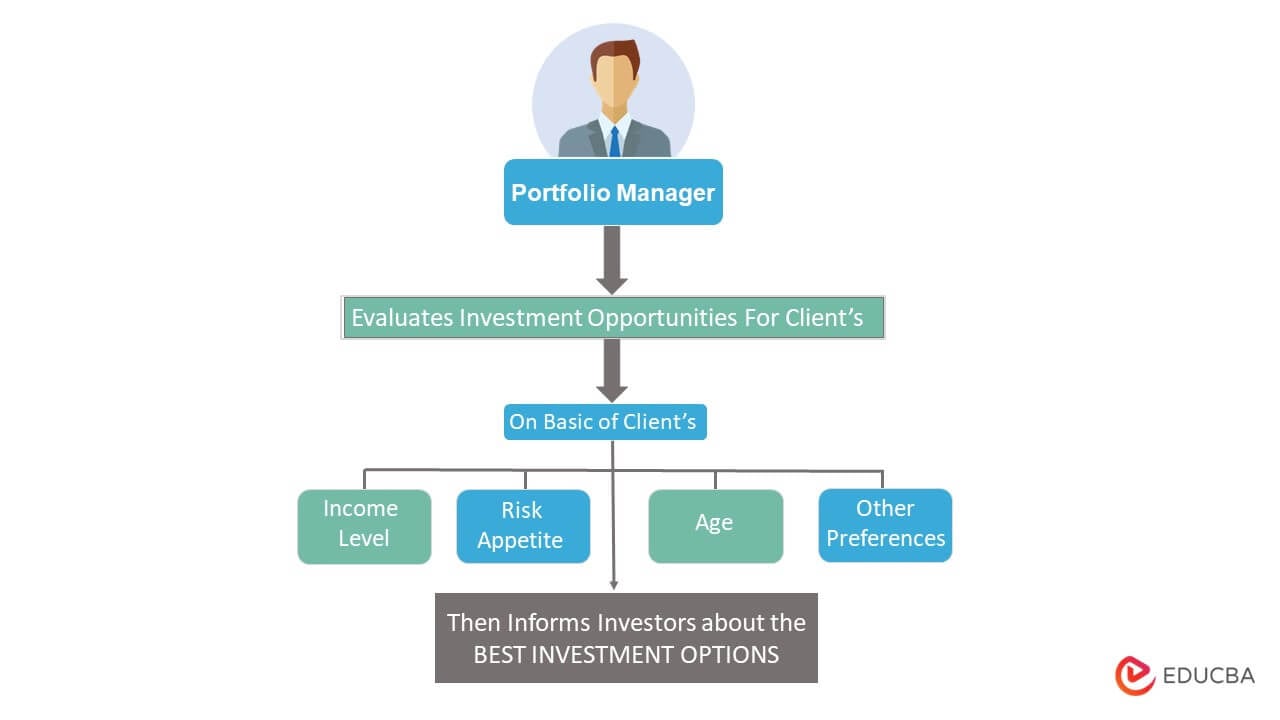

Portfolio Manager Managing Investors Investment Portfolios

20 Free Personal Loan Agreement Template Ms Word Best Collections

Ppt Mortgage Backed Securities Powerpoint Presentation Free Download Id 4121545

Lexington Law Review 2023 All You Need To Know With Pros Cons

Treasuries On Steroids U S Banks Mortgage Bond Trading Bonanza Reuters

Asset Backed Securities Rmbs Cmbs Cdos Wallstreetmojo

How I D Invest 250 000 Cash In Today S Bear Market

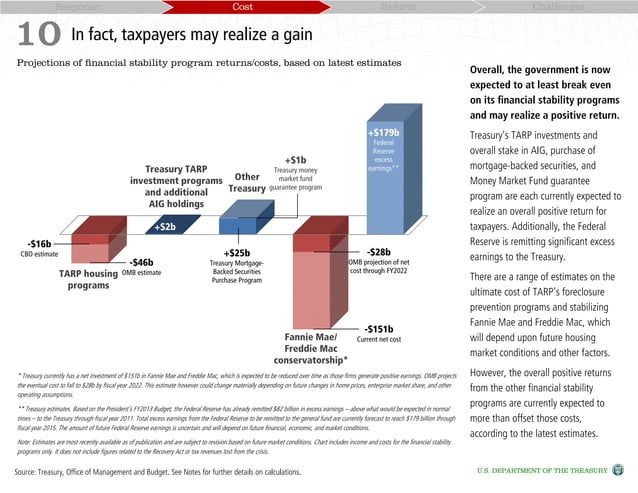

Response Cost Reform Challenges 10

C Ville Weekly April 21 27 2021 By C Ville Weekly Issuu

How Mortgage Backed Securities Work Part 1 Of 2

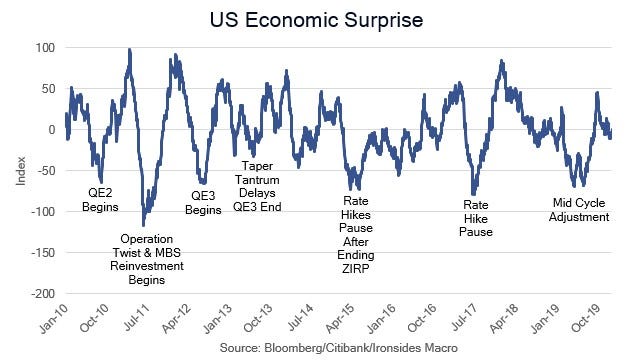

The Third Variable By Barry Knapp

20120413 Financial Crisisresponse Official Document Statistics Abou